Tax-Exempt Life Insurance in Canada

Unlocking the Power of Insurance

You may already be familiar with life insurance, but did you know that it can do so much more than just provide financial protection? At CRM Financial, we offer tax-exempt life insurance solutions that can serve as an alternative investment to low-yield, highly-taxed options like bonds and GICs.

With our tax-exempt life insurance, you can enjoy a worry-free investment that not only has the potential to grow at an equivalent taxable rate of return of more than 10%, but also offers tax-free access to your funds. What’s more, you can pass along the proceeds to your loved ones and favorite charities tax-free.

Let’s consider a sample case to illustrate the potential benefits:

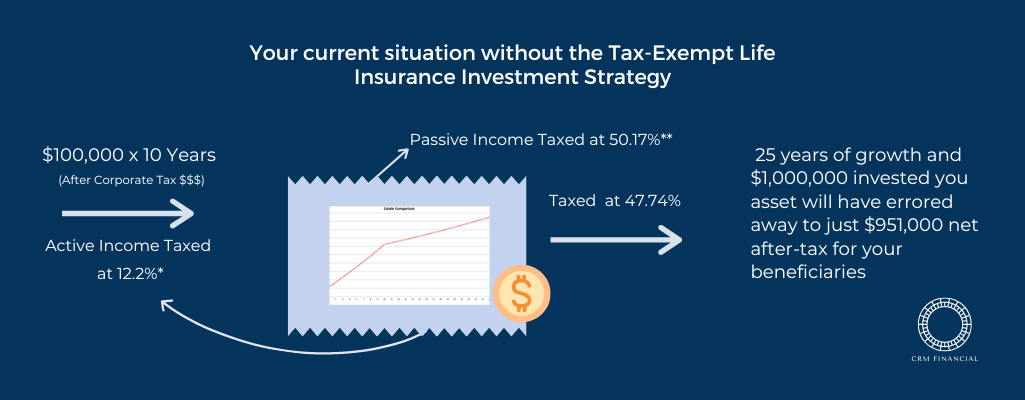

Current Situation:

- Married couple, age 65

- HoldCo deposits $100,000 annually into a standard investment for 10 years

- Funds earn an annual 4% rate of return

- After 25 years, beneficiaries receive net after-tax proceeds of approximately $951,000.

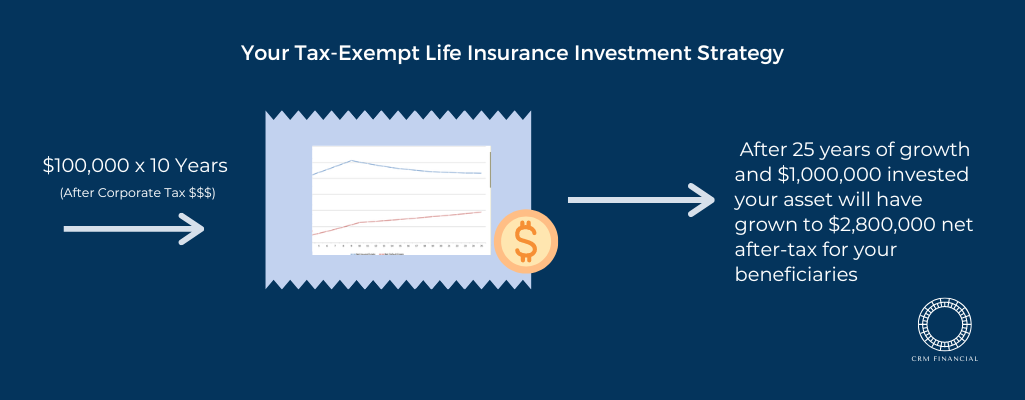

Tax-Exempt Life Insurance Investment:

- Married couple, age 65

- HoldCo deposits $100,000 annually into a standard investment for 10 years

- After 25 years, beneficiaries receive net after-tax proceeds of approximately $2.8 million, compared to $951,000 in the current situation

- The equivalent rate of return is approximately 13%.

These tax-exempt life insurance policies are particularly attractive to real estate investors and business owners with unrealized capital gains. If you qualify, you can even purchase life insurance using Immediate Financing Arrangements. This way, you only pay the interest cost, which is tax-deductible, while keeping your money invested in your real estate and business ventures.

Don’t miss out on the opportunity to keep more of what you’ve worked hard for.

Contact us now to learn how our tax-exempt life insurance strategy can benefit you and help you achieve your financial goals. Let’s embark on a journey toward financial security and peace of mind together.

Contact

Get In Touch

Ready to take the next step toward securing your financial future?

Contact us today for a consultation.